Important Notice

This site and the materials herein are directed only to certain types of investors and to persons in jurisdictions where IPC Alternative Real Estate Income Trust, Inc. (“ALT REIT”) is authorized for distribution.

Complete information about investing in shares of ALT REIT is available in the prospectus. An investment in ALT REIT involves risks.

DOWNLOAD PROSPECTUS

I acknowledge that (i) I have received the prospectus and (ii) either (a) I am a United States resident or (b) I have otherwise received authorization from ALT REIT or my broker-dealer/registered investment advisor to access the contents of this website.

Why ALT REIT?

ALT REIT is Inland’s flagship investment solution focused on providing investors access to a diversified portfolio of demographic-driven alternative real estate

|

INVESTMENT STRATEGY

|

INVESTMENT STRATEGY

|

INVESTOR EXPERIENCE

|

|

*Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds. Distributions may also be funded in significant part, directly or indirectly, from the deferral of certain advisory fees, that may be subject to repayment to ALT REIT’s advisor and/or the reimbursement of certain operating expenses, that may be subject to repayment to ALT REIT’s advisor and its affiliates.

|

There is no guarantee that the company’s investment objectives will be met.

**ALT REIT's NAV is calculated monthly based on the value of its investments (including securities investments), the addition of any other assets (such as cash on hand) and the deduction of any other liabilities. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated.

***Stockholders may request a repurchase of all or any portion of their shares on a monthly basis, subject to certain limitations, pursuant to ALT REIT’s share repurchase plan. ALT REIT's board of directors may make exceptions to, modify or suspend the share repurchase plan. Please consult the prospectus for more information.

|

INVESTMENT STRATEGY

|

INVESTMENT STRATEGY

|

INVESTOR EXPERIENCE

|

|

*Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds. Distributions may also be funded in significant part, directly or indirectly, from the deferral of certain advisory fees, that may be subject to repayment to ALT REIT’s advisor and/or the reimbursement of certain operating expenses, that may be subject to repayment to ALT REIT’s advisor and its affiliates.

|

There is no guarantee that the company’s investment objectives will be met.

**ALT REIT's NAV is calculated monthly based on the value of its investments (including securities investments), the addition of any other assets (such as cash on hand) and the deduction of any other liabilities. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated.

***Stockholders may request a repurchase of all or any portion of their shares on a monthly basis, subject to certain limitations, pursuant to ALT REIT’s share repurchase plan. ALT REIT's board of directors may make exceptions to, modify or suspend the share repurchase plan. Please consult the prospectus for more information.

Demographic-Driven Alternative Real Estate

-

Consistent demand from life events

-

Growth in aging population and healthcare spending

-

Strong return on investment for higher education

CAPITALIZATING ON A GENERATIONAL OPPORTUNITY

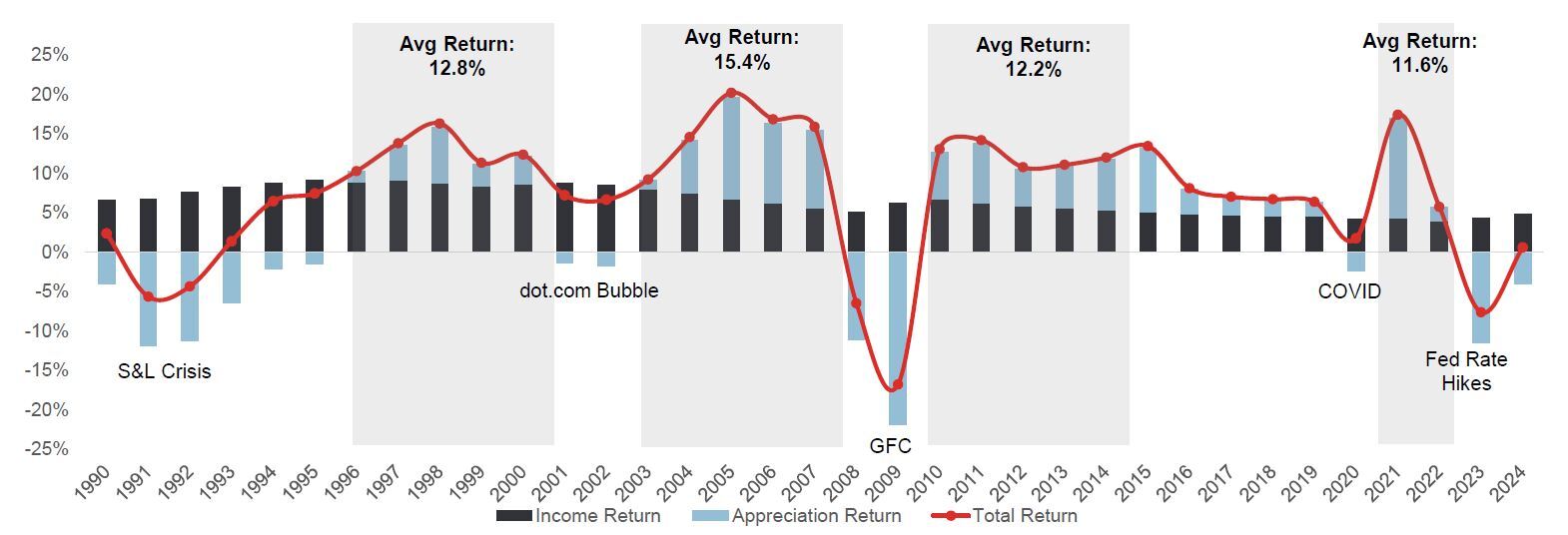

Private real estate has provided strong returns after repricing cycles while income generation remains positive for more than 30 years. With the recent decrease in valuations, we believe a rare opportunity is presented to invest at lower prices before the next recovery.

- Average return from 1990 to 2024 was 7.4%

- Investments made during repricing cycles have historically outperformed the long-term average

- Current peak-to-trough drawdown is second largest on record

- Today's market provides a compelling entry point into private real estate for enhanced return potential

Past performance is not a guarantee of future results. Charts for illustrative purposes only. Asset allocation does not ensure a profit or protect against a loss. An investment cannot be made directly in an index. ALT REIT has material differences from a direct investment in real estate, including related to fees and expenses, liquidity and tax treatment. Shares of ALT REIT do not trade on a national securities exchange and repurchase of shares by ALT REIT are subject to availability liquidity and other significant restrictions.

NCREIF – ODCE; data calculated from properties held in NCREIF NFI-ODCE Funds.

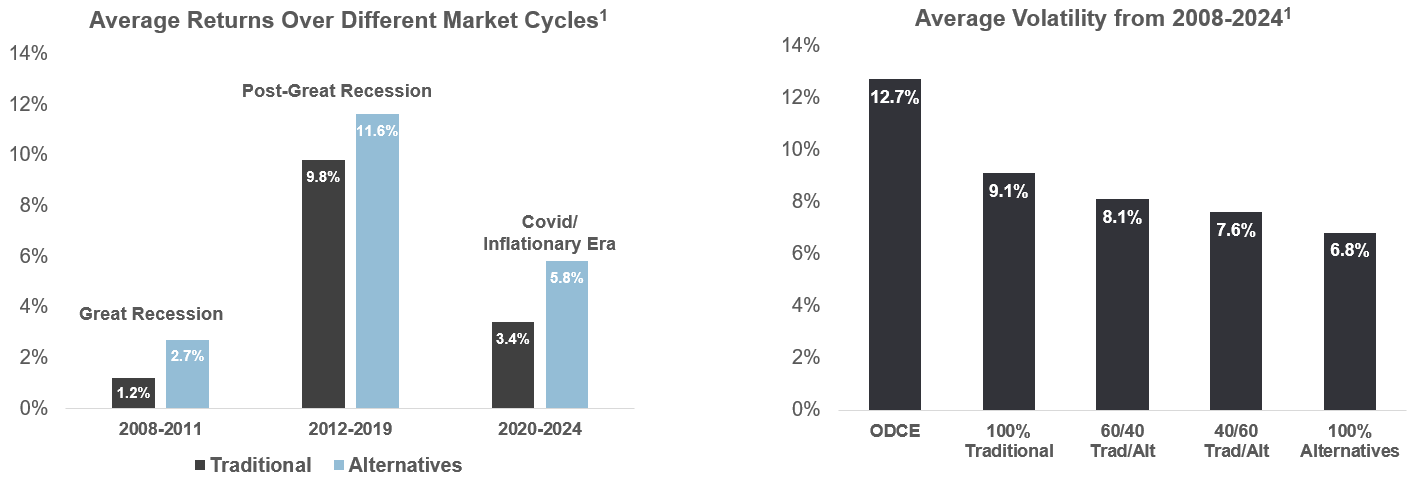

ALTERNATIVE REAL ESTATE SECTORS: MARKET RESILIENCE AND NOTABLE HISTORIC PERFORMANCE

Past performance is not a guarantee of future results. Chart for illustrative purposes only. Data source is NCREIF – Expanded NPI and ODCE – Q4 2024. An investment cannot be made directly in an index. Direct real estate is represented by the NCREIF Property Index (NPI). The NPI is a leading benchmark of institutionally owned, private real estate programs. The NPI is based on the unleveraged returns from a large pool of individual, investment grade commercial real estate properties across retail, office, industrial, and apartment sectors. The market values of the properties in the NPI are determined by appraisals rather than by market-based prices of the programs. While the NPI is not a measure of non-listed REIT performance, ALT REIT management generally believes that the NPI is an appropriate and accepted index for the purpose of evaluating real estate returns and risks against other types of investments. The NPI is not a measure of non-listed REIT performance, since non-listed REITs use leverage; require the payment of up-front and other fees that typically exceed those of institutional programs; subject to expenses related to being a public company and fees and expenses associated with raising capital. These fees and expenses lower non-listed REIT returns. The NPI does not reflect management fees and other investment entity fees, costs and expenses that are typical of non-listed REITs. In addition, non-listed REITs are illiquid and their investment goals and objectives, as well as their strategies, may differ from the entities represented in the NPI. Non-listed REIT also differ from the NPI since a portion of the REIT’s holdings may consist of loans and other real estate-related investments, while the NPI is a measure of performance of equity investments in institutional properties that consist of office, industrial and retail. Asset allocation/diversification does not guarantee a profit or protect against a loss in a declining market. Past performance is no guarantee of future results. There can be no assurance that we will be able to identify or acquire investments in any particular asset classes or in any particular concentration or ratio or that we will meet our investment objectives.

NCREIF – Expanded NPI and ODCE – Q4 2024. “Traditional” category is comprised of 25% Office, 25% Industrial, 25% Retail, 25% Apartment and “Alternatives” category is comprised of 25% Self-Storage, 25% Senior Housing, 25% Student Housing, 25% Medical Office.

The ALT REIT Value Proposition

Limited Exposure

Access to Inland's Platform

Current Distributions*

Attractive Entry Point

Reset in real estate valuations with compelling supply/demand dynamics

Enhanced Portfolio Expansion

Ability to acquire assets through Inland's 721 exchange platform of existing DST portfolios

No Legacy Portfolio

New vintage fund with recently acquired assets and no office exposure

*Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds. Distributions may also be funded in significant part, directly or indirectly, from the deferral of certain advisory fees, that may be subject to repayment to ALT REIT’s advisor and/or the reimbursement of certain operating expenses, that may be subject to repayment to ALT REIT’s advisor and its affiliates. Past performance is not a guarantee of future results. There is no guarantee that the company’s investment objectives will be met.

OUR TEAM

Leadership

Denise Kramer, CFA

Chief Executive Officer

Denise Kramer, CFA, serves as the Company’s Chief Executive Officer and as Chief Executive Officer of IPC Alternative Real Estate Advisor, LLC, the Company’s external advisor, roles she has held since October 2025. Prior to her appointment as Chief Executive Officer, Ms. Kramer served as the Company’s Chief Operating Officer, Lead Portfolio Manager from June 2023 through October 2025. Ms. Kramer also serves as the Chief Executive Officer and a director of InPoint Commercial Real Estate Income, Inc. (“InPoint”), positions she has held since December 2024, and as the President of InPoint’s advisor, Inland InPoint Advisor, LLC, a position she has held since January 2022. In addition, Ms. Kramer has served as Senior Vice President, Investment Product Management of IREIC since December 2022. Ms. Kramer began her career with Inland in 2016, serving as Senior Vice President, Investment Product Research for Inland Securities Corporation, Inland’s managing broker dealer. Prior to joining Inland, Ms. Kramer served as Director of Investment Research at Advisor Group from January 2010 to August 2016.

Ms. Kramer has a B.A. in accounting from the University of Maine and a Master’s degree in finance from Northeastern University. She holds Series 7 and 66 licenses with FINRA, and is a CFA Charterholder.

Rahul Sehgal

Chief Investment Officer

Rahul Sehgal serves as our Chief Investment Officer. Mr. Sehgal has been a director of IPC since May 2012 and the Chief Investment Officer and Executive Vice President of IPC since November 2012 and August 2022, respectively. Mr. Sehgal joined IPC in 2004 and has held various positions with IPC throughout his tenure with the firm.

Mr. Sehgal currently oversees IPC’s investment strategies, including acquisitions, dispositions, refinancing, tenant negotiations and portfolio review on behalf of ownership. In addition, Mr. Sehgal is responsible for the exploration of new asset classes and coordinating market research to collaborate with executive management in implementing the company’s long term strategic plans.

Mr. Sehgal received his B.A. in finance from the University of Illinois at Urbana-Champaign. He holds Series 7, 63 and 79 licenses with FINRA.

Joseph Binder

Chief Capital Officer

Joseph E. Binder serves as our Chief Capital Officer. Mr. Binder currently serves as IPC’s Executive Vice President of Acquisition Structure and Finance, a position he has held since January 2019. Mr. Binder joined IPC in 2008 and has served as a senior member of Inland Private Capital Corporation (IPC) management team leading the underwriting, due diligence, and structuring of its acquisitions, along with all debt capital market transactions and corporate lines of credit. In his time with IPC, Mr. Binder has overseen transactions in excess of $14 billion in investment real estate across nearly all asset types and a variety of investment structures and joint ventures.

Mr. Binder also serves as the Chief Investment Officer of The Inland Real Estate Group, LLC (Inland), a position he assumed in December of 2024. As CIO, Mr. Binder is responsible for managing and executing Inland’s investment strategies and capital markets activities and related strategic transactions.

Mr. Binder received a bachelor’s degree in finance from the University of Wisconsin at Whitewater and began his career in 2004 working in commercial real estate brokerage, followed by work in the commercial mortgage-backed securities industry. Mr. Binder holds an Illinois Real Estate Broker’s license.

Jerry Kyriazis

Chief Financial Officer

Jerry Kyriazis serves as our Chief Financial Officer. Mr. Kyriazis also has served as the Chief Financial Officer and Treasurer of the MH Ventures Fund III, LLC and its business manager since their inception in September 2022, and as the Chief Financial Officer and Treasurer of MH Ventures Fund II, LLC and its business manager since their inception in September 2022. Mr. Kryriazis joined Inland in 2018 as a Senior Vice President, Director of Portfolio Finance for IREIC serving several Inland entities, including IREIT and InPoint, MH Ventures 2019.

Prior to joining Inland, Mr. Kyriazis served as Director of Financial Reporting and Accounting Policy for Citadel LLC (a global hedge fund manager) from 2007 to 2018. He served as Vice President, Finance and Chief Accounting Officer for Trizec Properties, Inc. (a public office real estate investment trust) from 2002 to 2007. He also served as Vice president, Controller for LaSalle Hotel Properties (a public hotel real estate investment trust) from 1998 to 2000. Mr. Kyriazis worked for PricewaterhouseCoopers LLP from 1990 to 1998.

Mr. Kyriazis received his MBA from the J.L. Kellogg Graduate School of Management at Northwestern University. Mr. Kyriazis received his B.A. in accounting from Northern Illinois University. Mr. Kyriazis is a certified public accountant and a member of the American Institute of Certified Public Accountants and the Illinois CPA Society.

Daniel Zatloukal

Executive Vice President & Head of Asset Management

Daniel W. Zatloukal serves as our Executive Vice President and Head of Asset Management. Mr. Zatloukal has served as Senior Vice President of IPC since 2014. Mr. Zatloukal also serves as the Executive Vice President for IREIC Asset Management, as well as the Senior Vice President of IREIT, positions he has held since July 2017 and December 2021, respectively, and reports directly to the Chief Executive Officer of IREIC. In his role as Executive Vice President for IREIC Asset Management, Mr. Zatloukal is responsible for overseeing the asset management function for IREIC and all of its affiliates.

Mr. Zatloukal also served as the President of Inland Commercial Real Estate Services LLC and Inland Venture Real Estate Services, LLC from May 2016 through June 2017. Mr. Zatloukal rejoined IPC in February 2013 after previously working for IPC from 2004 through 2007 in the structuring and financing department. Prior to rejoining Inland, Mr. Zatloukal served as Vice President of Capital Markets at Jones Lang LaSalle in Atlanta from 2007 through 2013.

Mr. Zatloukal received his B.A. in finance from the University of Illinois at Urbana-Champaign.