Important Notice

This site and the materials herein are directed only to certain types of investors and to persons in jurisdictions where IPC Alternative Real Estate Income Trust, Inc. (“ALT REIT”) is authorized for distribution.

Complete information about investing in shares of ALT REIT is available in the prospectus. An investment in ALT REIT involves risks.

DOWNLOAD PROSPECTUS

I acknowledge that (i) I have received the prospectus and (ii) either (a) I am a United States resident or (b) I have otherwise received authorization from ALT REIT or my broker-dealer/registered investment advisor to access the contents of this website.

Cycle-Tested Alternative Real Estate Sectors

The Case for Alternative Real Estate

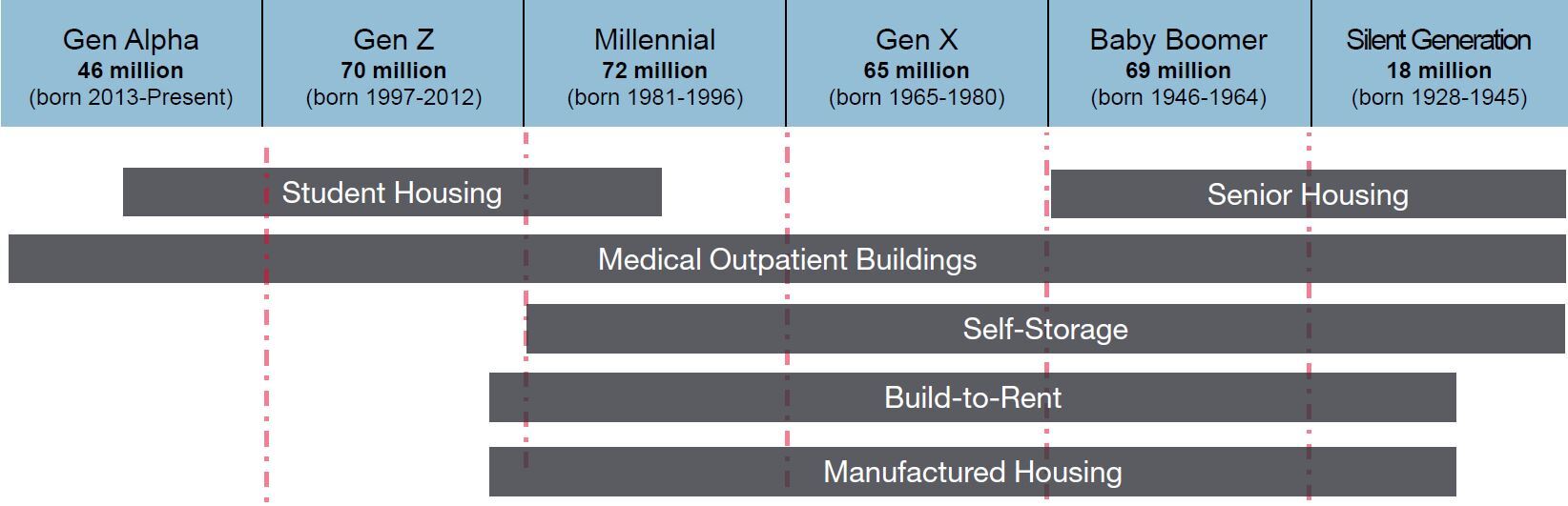

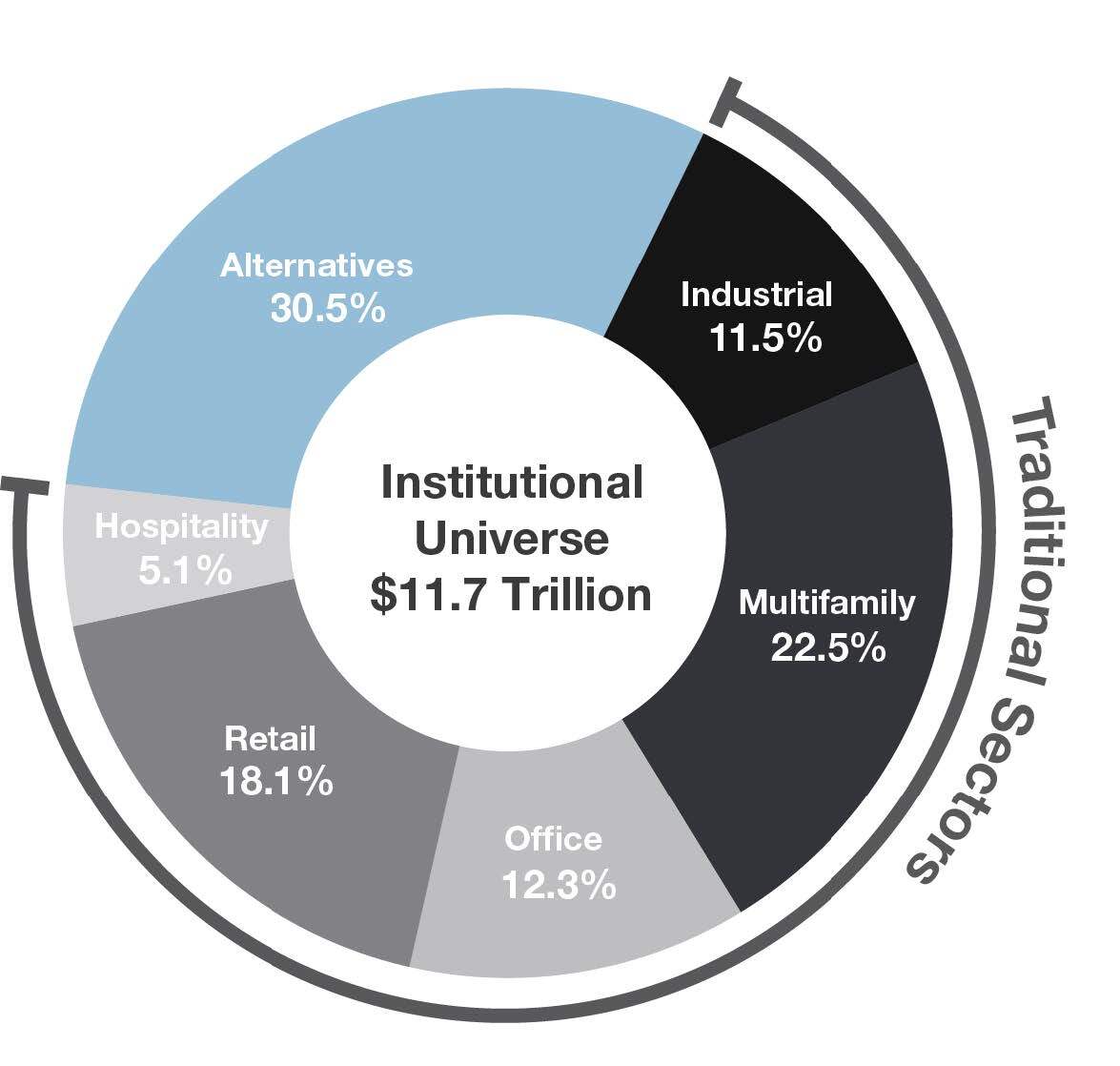

Institutional investors have been reassessing real estate portfolio allocations, which have historically focused on traditional property sectors. Looking to alternative real estate sectors, investors are finding lower correlations to both traditional real estate sectors and macroeconomic environments.

• Demand driven by life events

• Strong demographic tailwinds

• Proven resilience across market cycles

• Lower correlations to macroeconomic environments

• Lower volatility

• Limited and underrepresented access

• High barriers to entry

• Fragmented ownership

Opinions expressed reflect the current opinions of ALT REIT as of the date appearing in the materials only and are based on ALT REIT's opinions of the current market environment, which is subject to change. Institutional investors invest under substantially different terms than are offered to ALT REIT investors.

Chart source: Clarion Partners. The U.S. Commercial Real Estate Investable Universe. September 2024.

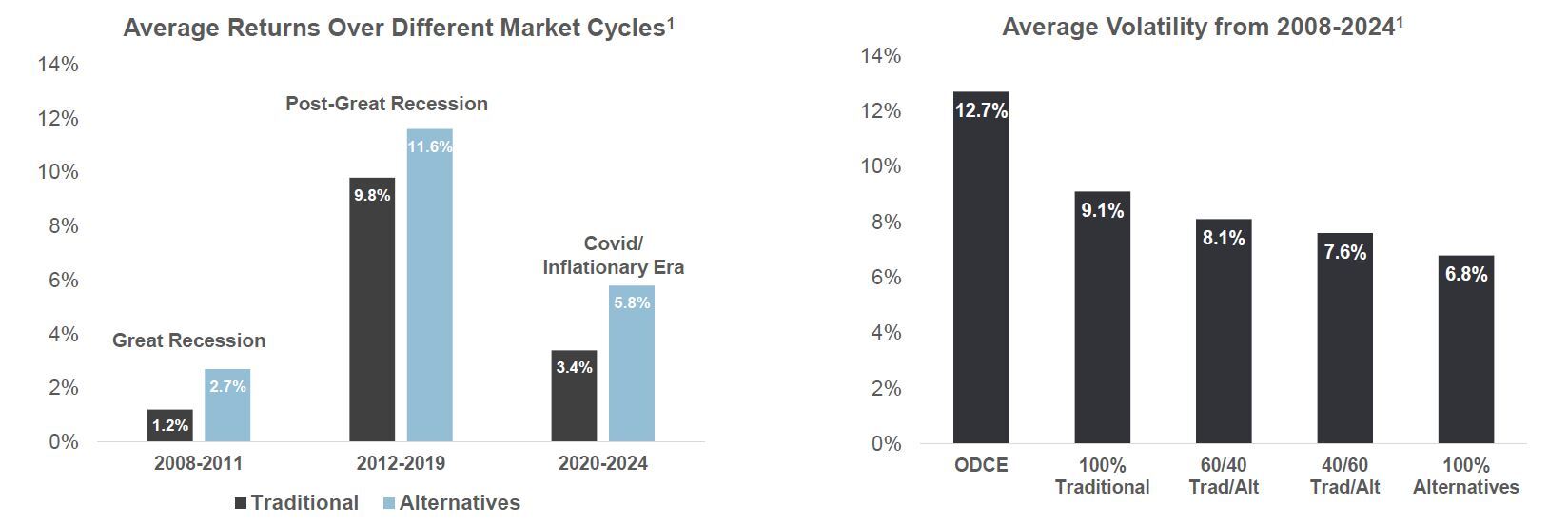

Alternative Real Estate Sectors Outperform Throughout Various Market Cycles

Alternative real estate sectors – self-storage, healthcare, and student housing – demonstrated both resilience and notable performance throughout the Global Financial Crisis and the global COVID-19 pandemic, as well as the subsequent recovery periods, highlighting the strength of these sectors as a long-term real estate investment strategy.

The ODCE Index reports on several alternative real estate sectors, including self-storage, data centers, senior housing, student housing, single-family rentals, life sciences, and hospitality.

Past performance is not a guarantee of future results. Chart for illustrative purposes only. Data source is NCREIF – Expanded NPI and ODCE – Q4 2024. An investment cannot be made directly in an index. Direct real estate is represented by the NCREIF Property Index (NPI). The NPI is a leading benchmark of institutionally owned, private real estate programs. The NPI is based on the unleveraged returns from a large pool of individual, investment grade commercial real estate properties across retail, office, industrial, and apartment sectors. The market values of the properties in the NPI are determined by appraisals rather than by market-based prices of the programs. While the NPI is not a measure of non-listed REIT performance, ALT REIT management generally believes that the NPI is an appropriate and accepted index for the purpose of evaluating real estate returns and risks against other types of investments. The NPI is not a measure of non-listed REIT performance, since non-listed REITs use leverage; require the payment of up-front and other fees that typically exceed those of institutional programs; subject to expenses related to being a public company and fees and expenses associated with raising capital. These fees and expenses lower non-listed REIT returns. The NPI does not reflect management fees and other investment entity fees, costs and expenses that are typical of non-listed REITs. In addition, non-listed REITs are illiquid and their investment goals and objectives, as well as their strategies, may differ from the entities represented in the NPI. Non-listed REIT also differ from the NPI since a portion of the REIT’s holdings may consist of loans and other real estate-related investments, while the NPI is a measure of performance of equity investments in institutional properties that consist of office, industrial and retail. Asset allocation/diversification does not guarantee a profit or protect against a loss in a declining market. Past performance is no guarantee of future results. There can be no assurance that we will be able to identify or acquire investments in any particular asset classes or in any particular concentration or ratio or that we will meet our investment objectives.

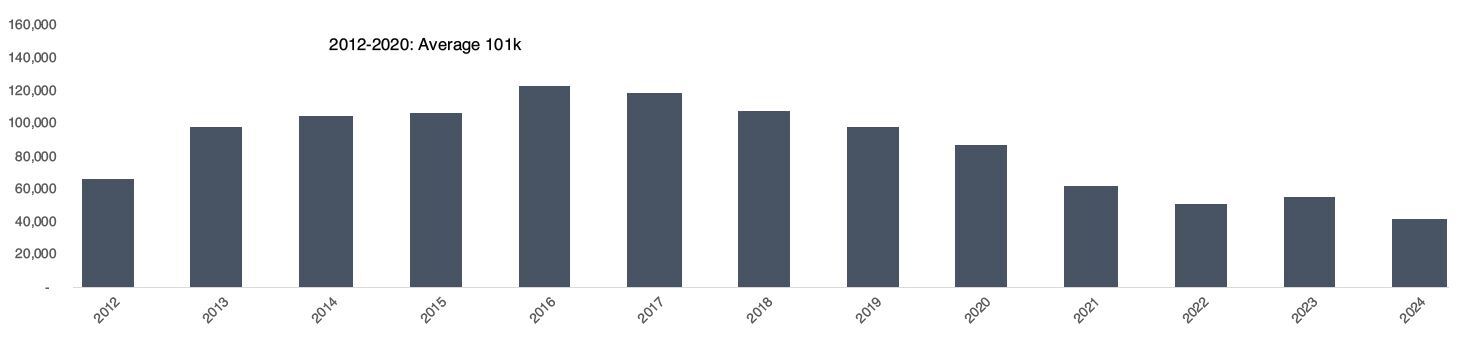

SELF-STORAGE

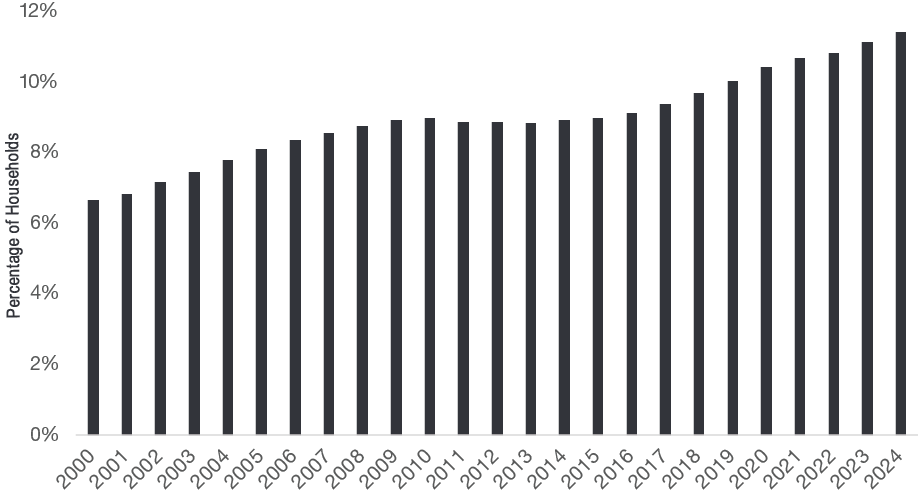

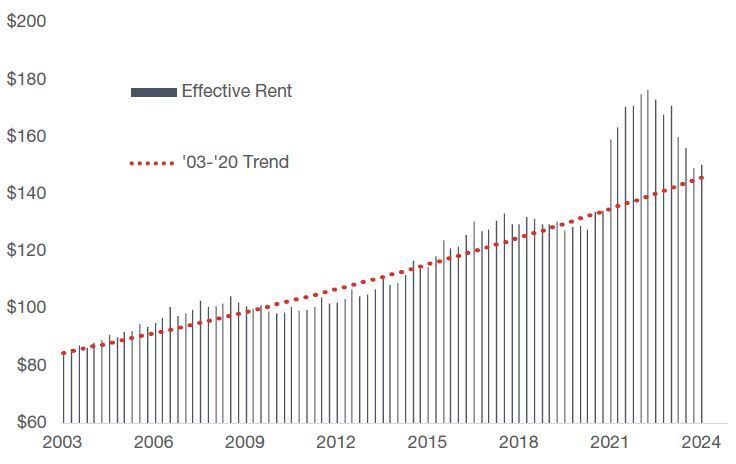

Cycle-Resistant Fundamentals and Consistent Demand

Life transitions such as dislocation, downsizing, divorce, and death continue to drive self-storage occupancy—regardless of the economic environment.

Key Attributes of Self-Storage:

- Strong Inflation Hedge: Monthly leases allow for real-time adjustments to market conditions.

- Low Capital Expenditures: Facilities require minimal ongoing capital compared to other property types.

- Low Tenant Sensitivity to Repricing: Less cost-sensitive to budgetary decision making.

HEALTHCARE

Increased Demand Due to Aging U.S. Population

All Baby Boomers will reach 65 by 2030 driving increased demand for healthcare real estate, including the vital medical outpatient building and senior housing community subsectors.

MEDICAL OUTPATIENT BUILDINGS

Outpatient Care Growing Rapidly as Demographic Demand Shifts

Medical outpatient buildings (MOBs) are a cornerstone of modern healthcare delivery—providing critical services in

accessible, lower-cost settings outside of traditional hospital environments. These purpose-built facilities support a broad range of outpatient care, helping meet the growing demand for convenient, patient-focused healthcare.

Key Attributes of Medical Outpatient Buildings

-

Rising Chronic Care Needs: Fueled by longevity and demographic change.

-

Mental Health & Long-Term Care Expansion: Heightened focus on behavioral health and extended care services.

-

Technological Advancements: Innovation enabling more care to shift to outpatient settings.

-

Convenient, Accessible Locations: Strong patient preference for community-based, drive-up care.

-

High Occupancy, Tenant Retention & Durable Income: High retention rates, long lease terms, and mission-critical operations support predictable cash flow.

SENIOR HOUSING

Accelerating Demand from Aging Population Amplified Inadequate Supply

The senior housing sector uniquely combines housing, healthcare and hospitality—offering tailored environments that support independence, wellness, and care as residents age. As the 80+ population grows and families become more geographically dispersed, the need for quality, service-rich senior housing continues to rise.

Key Attributes of Senior Housing

-

Growth of Seniors: 80+ population is projected to double by 2038.*

-

Extended Longevity: Growing demand among active, independent older residents.

-

Familial Separation: Increased reliance on professionally managed care and housing.

-

Constrained Supply: Limited development amid rising demand.

-

Occupancy Gains: 14 consecutive quarters of increases.**

* NIC. Looking into the Future: How Much Seniors Housing Will Be Needed?

** NIC. News & Press Releases. Occupied Senior Housing Units Reach New High. January 16, 2025.

Represents ALT REIT’s view of the current market environment as of the date appearing in this material only. There can be no assurance that we will be able to implement our investment strategy, achieve our investment objectives or avoid substantial losses. An investment in ALT REIT has material differences from a direct investment in real estate, including related to fees and expenses, liquidity and tax treatment.

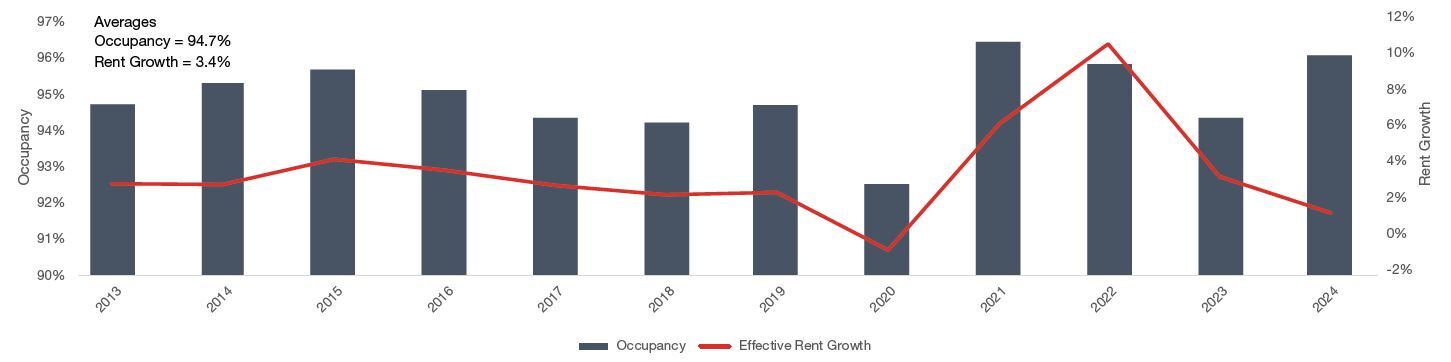

STUDENT HOUSING

Strong Fundamentals Aid in Multi-Decade Durability

Student housing represents a resilient asset class underpinned by consistent enrollment trends, limited on-campus housing, and a growing preference for purpose-built, professionally managed accommodations.

Key Attributes of Student Housing:

-

Historical Recession Resilience: Higher education enrollment often increases in economic downturns.

-

Durable Income: Predictable revenue stream with pre-leased units and rents guaranteed by parents or guardians.

-

Under Supply of Purpose-Built Housing: Limited housing options available in and around top-tier universities drives consistent demand and strong rental growth.

-

Established Benefits of College Education: Degree holders experience lower unemployment, higher lifetime earnings and greater job stability.